Course 107: Data Protection Fundamentals

Date:The Data Protection Officer (DPO) is a previously existing role that has been rendered mandatory in certain instances by the General Data Protection Regulation (GDPR). DPOs are responsible for overseeing data protection strategy and implementation to ensure compliance with GDPR requirements. Now that the GDPR is in force, it is important that organisations are compliant with the many regulations and operational requirements provided by the GDPR. This course is designed to help DPOs fully understand their role, assisting them in setting up of the right processes and procedures as well as control measures and helping DPOs determine whether the appointment of a DPO is mandatory for their organisation. In view of this and the significant possible consequences of noncompliance, it is recommended that DPOs attend this course.

Course 118: Effective Business Writing

Date:Whether at top executive, middle management or even junior administrator level, conveying information, a message or even intent clearly, flawlessly and in appropriate detail is critical for getting the message across, establishing attention, winning business and building continued success. Business writing must form a credible basis upon which sound decisions may be taken. In this regard, besides communicating information accurately in an appropriate format, effective business writing demonstrates rationale, enhances credibility, carries influential impact, and conveys suitable courtesy. All powerful determinants for maintaining interest, rapport and enhancing sustainable achievement in the world of business. This short course gives practitioners, managers and administrators insights into sharpening and enhancing their business writing and communication skills in multiple and varied business contexts such as writing with impact and garnering results, drawing up reports as a sound basis for decision-making and outcome reporting, minute taking as well as delivering and presenting to an audience.

Course 109: Financial Planning – What do you need to know

Date:Overview of the financial planning process and financial planning subject areas covering the fact-finding process, good practices, client needs, protection, borrowings, saving and investment, pension planning, estate and inheritance planning. Latest guidance regarding requirements to include client sustainability preferences in the fact-finding and advice.

Course 219: AML/CFT - Spotting the Red Flags

Date:This course aims at providing attendees with the necessary tools and techniques aimed at identifying money laundering machinations and in combating the funding of terrorism. The course has been developed in an engaging and comprehensive format in order to provide attendees with the appropriate training to meet the regulatory requirements of subject persons whilst providing a practitioner’s insight. The course shall focus both on the applicable legislative framework as well as on practical case studies.

Course 108: Compliance Monitoring and Reporting

Date:The Compliance Officer is the regulator’s invisible arm in that it ensures that the institution’s business is being conducted in line with regulations, internal policies and procedures. Checks are carried out primarily through compliance monitoring programmes; be they on-site or desk based reviews. The fulcrum of the findings prompted by the reviews is to bring these to the attention of senior management. Senior management is ultimately responsible for the establishment and maintenance of the compliance function and in ensuring that the business is carried out in line with regulatory requirements.

Course 167: Generative Artificial Intelligence

Date:Immerse yourself in the innovative world of Artificial Intelligence (AI) with this engaging 2-hour course, “AI: An Exploration into ChatGPT and Midjourney.” This course aims to provide a robust understanding of the fundamental concepts of AI, with a special focus on Generative AI. Participants will gain valuable insights into the transformative power of Generative AI algorithms such as ChatGPT by OpenAI and Midjourney through the examination of the latest advancements and future trends. These ground-breaking technologies are shaping diverse professional fields, from Human Resources and Marketing to Education. The interactive session is designed to foster a deeper comprehension of how Generative AI can be tailored to address specific professional requirements of our participants. Attendees will depart with an enriched understanding of Generative AI, its real-world applications, its opportunities, risks, and challenges.

Course 160: Enterprise Risk Management: Adding Value to Your Organization

Date:This course is intended to educate and train professionals on the role of the risk function within an organization, and its effectiveness in acting as a second line of defense within the organization’s governance structure. The course will look into the practical implementation of risk and risk management, highlighting the main stages of a robust enterprise-wide risk management process.

Course 101: An Introduction to Funds and ETFs

Date:Open-ended funds and Exchange Traded Funds (ETFs) have become very popular, cost-effective and efficient ways for investors to build diversified portfolios. Funds are widely used by investors and include a wide variety of assets including bonds equities, real-estate and commodities. This course will focus primarily on the different types of funds available to investors ranging from Exchange Traded Funds (ETFs), to open-ended and closed-ended funds. The course will contrast ETFs versus traditional funds, differentiate between active and passive management, explain the prospectus, expense ratios and other key points.

Course 218: MLRO Best Practices in the Age of 6th AMLD

Date:As far as the creation of AML and Financial Crime Compliance policies is concerned, the gatekeeper, controller and the place where the “buck stops”, is the MLRO. This is a critically important position within any firm covered by AML Rules. When it comes to the identification, detection, escalation, reporting, managing and training of staff on Anti-Money Laundering procedures, it is the responsibility of the MLRO to ensure this all happens as effectively and efficiently as possible.

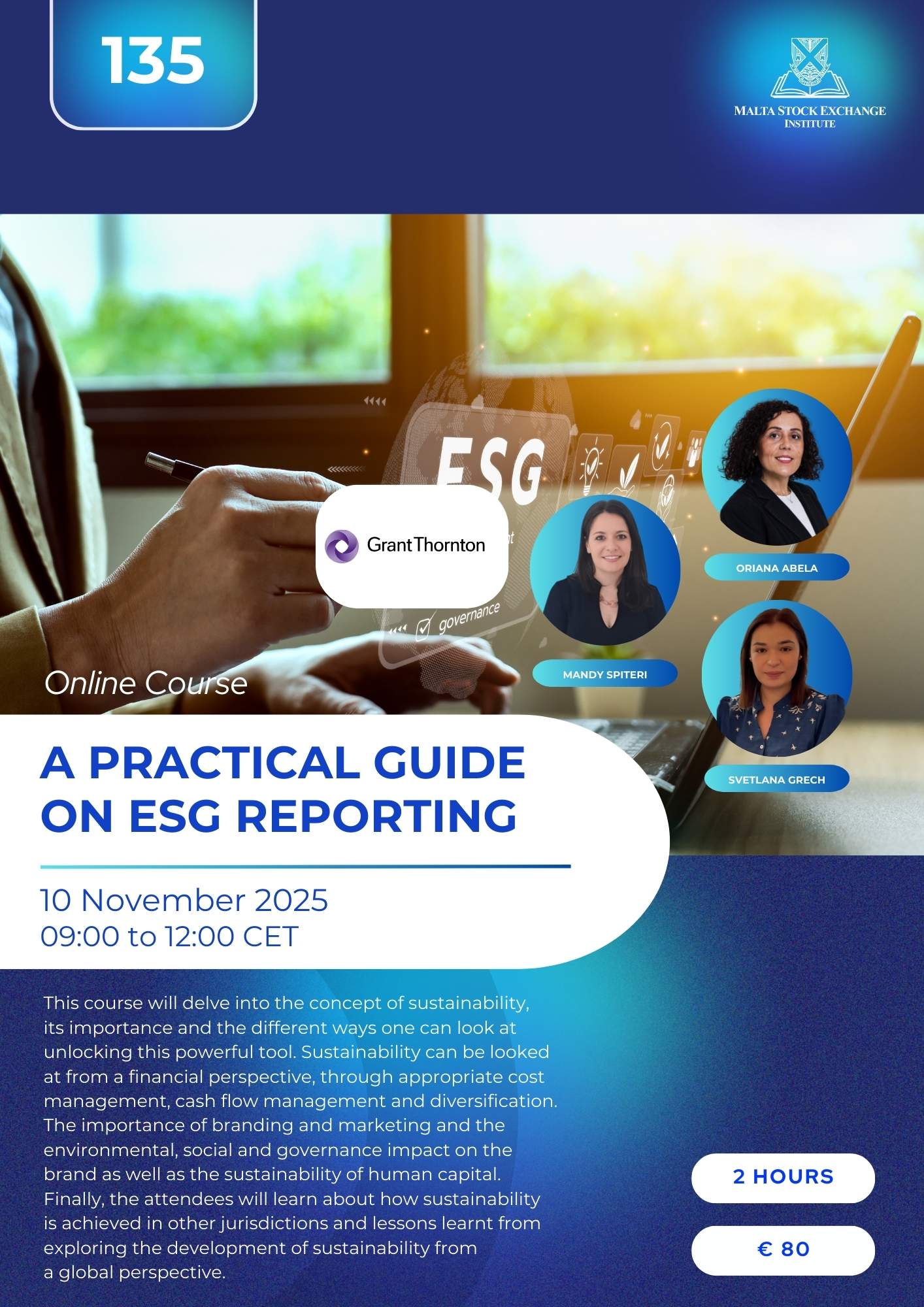

Course 135: A Practical Guide on ESG Reporting

Date:This course will delve into the concept of sustainability, its importance and the different ways one can look at unlocking this powerful tool. Sustainability can be looked at from a financial perspective, through appropriate cost management, cash flow management and diversification. The importance of branding and marketing and the environmental, social and governance impact on the brand as well as the sustainability of human capital. Finally, the attendees will learn about how sustainability is achieved in other jurisdictions and lessons learnt from exploring the development of sustainability from a global perspective.

.jpg)

Course 324: The Role of the Board

Date:Participants will gain a clear and focused understanding of the key role of directors and corporate secretaries in the management and administration of the company. Today, directors are being constantly evaluated and scrutinised by regulators and shareholders and is therefore essential directors appreciate the responsibility of the office, their duties, rights, obligations and the relationship with other stakeholders within the company. Participants will also be exposed to the liability directors face in the event of a breach or non-compliance with any applicable law. Recent judgments will also be considered. This course will also emphasise on corporate governance principles, best practices and the interpretation of various provisions of the Companies Act.

Course 243: Climate Financial Risks and Disclosures

Date:Climate financial risks and disclosures are increasingly recognized as essential components of sustainable finance, with various regulatory frameworks emerging to enhance transparency and accountability in this area. This course will guide you through the key aspects of climate change risks and their corresponding disclosures, with a primary focus on those aligned with the European Sustainability Reporting Standards (ESRS).

Course 225: Source of Wealth & Source of Funds: Regulatory Guidance

Date:The training will focus on Source of Wealth and Source of Funds obligations and what to look out for as well as information and documentation a Subject Person is expected to collate when there is third-party involvement. Reference will also be made to the FIAU Guidance issued in July 2022, titled ‘On Obtaining Source of Wealth Information related to Parties other than the Customer’.

Course 311: Understanding Trusts

Date:Students will learn how trusts are legal relationship created by one party and places assets under the control of another party referred to as the trustee for the benefit of the beneficiary. Participants will learn the intricacies of trusts, and the legal and tax ramification of their setup. There will also be discussions related to how to properly craft trust deeds and articulate the powers of trustees. Also students will learn why trusts are formed such as for the protection of assets or estate planning and why trustee independence helps avoid any suggestion that the settlor continues to have control of the trust assets.

Course 214: Preparing for Inspections by the Regulators

Date:The FIAU and the MFSA can and are given authority by law to perform inspections on subject persons and licensed entities. This course is aimed at Designated Non-Financial Business Providers and Corporate Service Providers and will give insight on the different supervisory engagements carried out.

Course 245: Spotlight on Trusts - Understanding the AML Risks and Best Practices

Date:

This course delves into the AML/CFT challenges and risks associated with trusts, providing a practical framework for managing these risks effectively. It examines the unique vulnerabilities of trusts, focusing on beneficial ownership concealment and complex financial structures that can be exploited to launder illicit funds and sanctions evasion, amongst others.

The course addresses customer risk management, particularly wealth accumulation, SOW and SOW, offering actionable insights into compliance obligations and advanced risk mitigation techniques. Participants will gain an understanding of the legal requirements in terms of the PMLFTR and how to apply them effectively in practice when dealing with trust customers. Particular emphasis is placed on conducting due diligence on trusts and their beneficial owners, ensuring compliance with AML obligations while addressing practical challenges.

Through examples

and scenarios

, participants will gain the skills to identify red flags, evaluate trust structures, and implement robust control measures. This includes guidance on understanding the risk factors specific to trusts, enhancing due diligence procedures, and adopting effective strategies to mitigate risks and ensure compliance with AML regulations.

Course 238: Different Sources of Raising Capital

Date:Securing funding is a challenging yet vital aspect of managing any business. Even the most innovative ideas or well-crafted business plans can only take you so far. To achieve growth, businesses inevitably require financial support. While raising funds is one of the greatest hurdles businesses face, there are numerous avenues available, including capital markets, bank loans, private placements, and business angels, among others. This training session will provide a comprehensive overview of various funding sources, with a particular emphasis on the capital markets in Malta. It will also address the practical challenges encountered when raising funds and explore how businesses navigate these issues effectively.