Course 142: ESG: A Practical Overview

Date:This course aims to provide a high-level overview of Environmental (E), Social (S) and Governance (G) criteria (ESG), and will serve as a general introduction to this fast-growing and ever-changing sector. The course will be informally split into three distinct sections; the first of which will largely focus on the main tenets of ESG: what it means, what it seeks to achieve and its development through time. The second section of this course will focus on the pertinent regulatory developments in the ESG sector, including the Taxonomy Regulation, the Sustainable Finance Disclosures Regulation (SFDR) and the upcoming Corporate Sustainability Reporting Directive (CSRD), and their implications on market players falling within their scope. The third and final section of this course will then seek to provide examples of the practical applicability of ESG both locally and internationally, and will further explore what the future holds for this expanding sector.

Course 205: How Bonds Work

Date:Bonds are one of the most popular assets classes for many investors since they are generally seen as a reliable source of income with a defined investment term. This course will cover the basics of investing in bonds as well as the more complex features of this type of instrument. Participants will also learn about the key principles of bond pricing mechanisms, the structure of the fixed income markets, building a portfolio of bond instruments, and how to select bonds based on their characteristics such as yield and issuer credit analysis.

Course 103: Company Law Fundamentals

Date:The aim of this course is to provide participants with an overview of the fundamental precepts of Maltese company law. Following an analysis of the distinction between the various types of corporate vehicles available in terms of Maltese law, the course will focus on private and public limited liability company, from creation to dissolution. Fundamental doctrines such as separate legal personality, limited liability, and the lifting or piercing of the corporate veil will be analysed. The various types of share capital, the increase, reduction and transfer of share capital, and the doctrine of capital maintenance will also be discussed. This is followed by an analysis of the regulatory and practical implications of the governance of companies, in the context of a global trend towards more regulation and the need of companies to adhere to strict ethical and legal business practices so as not to jeopardize their corporate brand and business in general. Particular focus will be laid on the duties and responsibilities of directors and, specifically in respect of listed companies, the need to instil a governance culture aligned with the Code of Principles of Good Corporate Governance set out in the Listing Rules. In the final part of the course the substantive and procedural aspects of dissolution, winding up and insolvency, as well as the procedures of company rescue and corporate recovery will be examined.

Course 203: Financial Statements Analysis

Date:This course is an introduction to understanding how to use financial information to value and analyse companies. The course focuses on the practical application of financial statements analysis. Students will learn how to create and analyse financial ratios such as debt to equity, profit margins and more. Participants will gain analytical skills involved in reading and interpreting the financial health and profitability of a company through quantitative and qualitative techniques. A number of case studies and financial statements of actual companies will be analysed.

Course 139: Introduction to the Market Abuse Regulation

Date:This course will provide a high-level overview of the Market Abuse Regulation and will serve as an introduction for anyone unfamiliar with the Regulation. The course will include an overview of the three offences of insider dealing, unlawful disclosure of inside information, and market manipulation, the various obligations imposed on market participants by the Regulation, as well as central key themes such as inside information. Participants will also be given a general understanding of the MFSA’s oversight function in respect of market abuse and applicable sanctions. Practical examples will be provided throughout the course to better illustrate the issues being discussed.

Course 216: Fund Accounting and Administration

Date:The aim of this course is to give a brief overview of the different types of Collective Investment Schemes and to provide more information with regards to the tasks and responsibilities of the Fund Administrator. It will also give more insight on the different roles within the Fund Administration business. An explanation on how to calculate an NAV and on how to price different types of Instruments will be provided. After this course you will be able to understand the basic principles of Fund Accounting and Administration.

.jpg)

Course 153: Reporting Disclosures Emanating from the Capital Markets Rules

Date:This session will provide an in-depth look at the continuing disclosure obligations emanating from Chapter 5 of the Capital Markets Rules applicable to Issuers in terms of the said Rules. This session will cover both periodic financial reporting as well as ad hoc disclosure obligations, and should be particularly relevant to equity and debt issuers listed on the main market of the Malta Stock Exchange as well as entities contemplating listing.

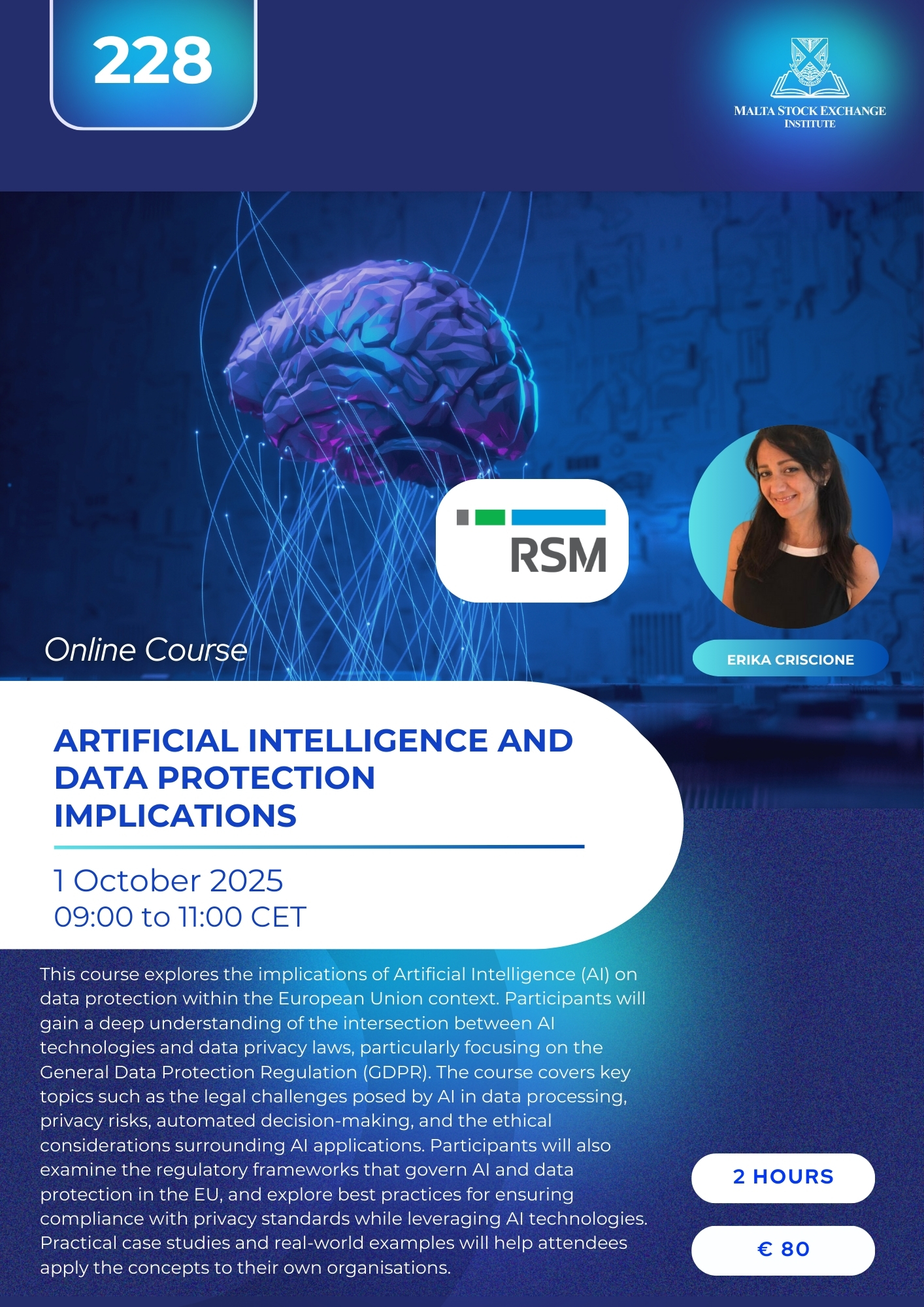

Course 228: Artificial Intelligence and Data Protection implications

Date:This course examines the intersection of artificial intelligence (AI) and data protection with a focus on European frameworks, particularly the General Data Protection Regulation (GDPR). Students will explore how AI systems interact with data privacy laws, addressing challenges such as algorithmic accountability, automated decision-making, and data minimization. Through case studies and practical insights, the course emphasizes designing AI solutions that align with EU data protection principles, ensuring ethical innovation while maintaining compliance with strict legal standards.

.png)

Course 170: Designing a Robust Business Risk Assessment

Date:This course has been tailored to provide attendees with a best practice approach in designing an organization’s business risk assessment. The course will explore how risk managers can apply an enterprise-wide risk management approach and transpose this into a business risk assessment, ensuring the organization’s risk profile factors in all the risks which may impact its operations and achievement of objectives.

Course 168: Real Estate Valuation Quality and Reviews

Date:This module will give a comprehensive overview of property valuations and reports, showing what a good quality and realistic valuation should assess, and explaining the methodology of creating a good quality property valuation. It will also address the common mistakes and errors commonly found in valuations and the importance of having a good standard of valuation since this is often the basis of investment decisions.

Course 119: Investing Essentials: Building a Diversified Portfolio

Date:This four-hour course is perfect for individuals seeking to enhance their investing expertise and build a well-rounded understanding of key investment concepts. Participants will gain practical insights into constructing a diversified portfolio tailored to their financial goals. Topics include an introduction to asset classes like stocks, bonds, and funds; the importance of diversification to minimize risk and maximize returns; and strategies for creating balanced portfolios. The course also explores the advantages of ETFs and index funds, diversification across geographies and sectors, and ways to avoid common investment pitfalls. Practical examples and virtual trading exercises will reinforce the concepts learned.

Course 239: The Importance of Ongoing Monitoring

Date:Once a subject person forms a business relationship with a customer, the PMLFTR states that ongoing monitoring obligations shall need to be adhered to. The extent and level of ongoing monitoring shall vary from subject person to subject person based on the services provided, the risk ratings of the customer population and any trigger events which may materialize.

Course 206: The Role of the Company Secretary

Date:This course focuses on the pivotal role, duties and obligations of the company secretary. The company secretary is an important link between the board of directors and the management arm of the company. There is also a duty to ensure good corporate governance. It is important that company secretaries are familiar with their obligations to the board, shareholders and management. The lecturer will also outline best practice and real-life case studies.

Course 246: The CRA and the Impact on CDD/EDD

Date:

A Customer

Risk Assessment (CRA) is a tool used to evaluate the risk level of customers to

prevent financial crimes. Being a critical component of customer due diligence

at onboarding and thereafter, it is the foundation of every risk-based AML

control framework.

.jpg)

Course 244: Systems Thinking and the Interconnectedness with the ESG Framework

Date:Throughout this course, we will explore and navigate through the key aspects of the three dimensions of ESG: Environmental, Social, and Governance. The main themes to be discussed encompass the importance of aligning ESG considerations with the overall business strategy, stakeholder engagement, risk management, and adherence to sustainability standards by adopting the ‘Systems Thinking’ approach. Integrating systems thinking into the ESG framework enhances the ability to navigate complexity and develop sustainable solutions. By understanding the intricate web of relationships and interdependencies within systems, ESG professionals can create more effective strategies that address the multifaceted challenges of sustainability.

.jpg)

Course 150: Cyber Security – End User Security Awareness

Date:Cyber security is a key issue that affects everyone in the digital environment we live and work in. The aim of this course is to ensure that the end user has enough security awareness to turn them into a strong last line of defence in identifying cyber-attacks and protecting your organisation. This interesting and practical course will help you and your staff in an interactive course. The key benefits will be the change in users’ behaviour to reduce risk from phishing and other cyber attacks, prioritisation and improvement of incident response and reporting of incidents and ultimately the reduction of successful phishing attacks and malware infections.

Course 306: Financial Markets Compliance and Regulation

Date:This course aims to offer participants an overview of the regulatory and compliance landscape by introducing elements of the AIFMD, MIFID, and UCITS directives. Students will be provided a foundation to be able to understand financial regulation and compliance requirements of an MFSA licensed company. The course will explore the optimal compliance structure of a fund or management company including their basic legal structure, the fiduciary duties of a board of directors, investment committee, MLRO, and compliance officer. Furthermore various AIFMD policies will be discussed including risk management, remuneration, valuation, insider dealing polices, etc.

Course 100: An Introduction to the Financial Markets

Date:Participants will learn the basic investing concepts, the many different variations of traditional investments available and which type of investments are most suitable for their needs. The course will delve into the history of the capital markets, their role in the economy, the different types of markets, and the activities of exchanges. Participants will also learn about the difference between bonds and equities, what they are, their special characteristics and terminology, how they are priced and the risks of owning such investments. Students will also learn about various investment styles such as value, growth, and fund investing. Students will be taught how to and why they should take a critical look at all investing options based on sound risk/reward assumptions.

Course 147: AML/CFT Fundamentals

Date:Complying with the AML/CFT framework is an increasingly important regulatory requirement for all subject persons. This course, two-part session will outline the applicable Maltese AML/CFT laws and regulations, provide in-depth coverage of key ML/TF obligations of subject persons and discuss the effective implementation of risk-based policies, procedures, controls and measures. Following this course, participants should have a much better understanding of the key concepts of ML/TF, typologies, trends, safeguards and measures.

Course 238: Different Sources of Raising Capital

Date:Raising capital is a difficult but essential part of running Capital markets - practical issues any business. Even the most creative ideas or business plans can only get you so far. It is therefore inevitable that businesses will need funding in order to grow. Although one of the biggest challenges businesses face is raising finance, various options exist and businesses can raise capital through capital markets, bank finance, private placements or business angels amongst others. The training session will give an overview of all sources of finance, focusing more on the capital markets available in Malta, and the practical issues encountered when raising finance and how business go around them.