News and Articles

Malita Investments plc

Update on Strategic Review and Works Suspension

Amalgamated Investments SICAV plc

Interim dividend

Mediterranean Maritime Hub Finance plc

Update on Investment Transaction

QLZH Holding Plc

Publication of Tranche 2 Final Terms

CPHCL Finance plc

Issue of €45,000,000 CPHCL Finance p.l.c. 5.35% Unsecured Bonds 2035 (the “Bonds”) - Earlier closure of offer period

Central Business Centres plc

Series 1 Tranche 1 €13,250,000 5.7% unsecured bonds due 2030 – 2035 - Basis of Acceptance

Listing of MedservRegis plc

€17,040,000 5.5% MedservRegis plc Unsecured Euro Bonds 2031-2036 $5,900,000 6.5% MedservRegis plc Unsecured USD Bonds 2031-2036

Listing of Malta Government Stocks (Retail)

€20,910,300 2.55% MGS 2030 (V) R €41,689,800 3.40% MGS 2035 (IV) FI R €40,638,700 3.80% MGS 2040 (II) FI R

Listing of Plan Group plc

€28,200,000 5.10% Plan Group plc Secured Bonds 2028-2030

Listing of SD Finance plc

€33,000,000 5.20% SD Finance plc Unsecured € Bonds 2031 S1 T1

Listing of James B Finance plc

€30,000,000 5.35% James B Finance plc Partly Secured & Guaranteed € Bond 2035

Listing of HH Finance Plc Secured Bonds

€24,129,700 5.2% HH Finance Plc Secured Bonds 2035

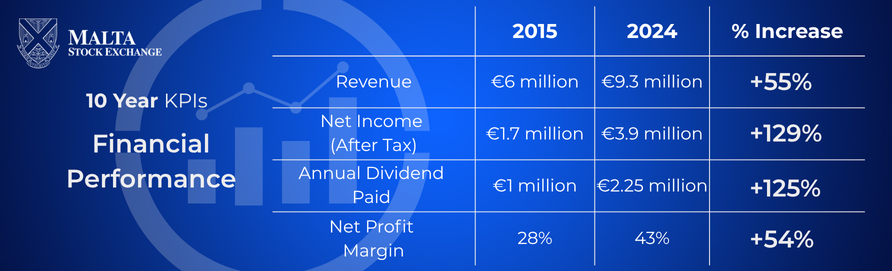

Malta Stock Exchange Achieves Strong Growth Over the Past Decade

Malta Stock Exchange Achieves Strong Growth Over the Past Decade

Malta Stock Exchange Achieves Record Financial Results in 2024, Strengthens Strategic Position

Malta Stock Exchange Achieves Record Financial Results in 2024, Strengthens Strategic Position

Malta Stock Exchange Hosts Second Roundtable Event Focusing on Market Liquidity Enhancement Initiatives

Malta Stock Exchange Hosts Second Roundtable Event Focusing on Market Liquidity Enhancement Initiatives

MSE holds Annual Awards Dinner 2024

Malta Stock Exchange holds Annual Awards Dinner

Malta Stock Exchange Rings The Bell for Financial Literacy

Malta Stock Exchange Rings The Bell for Financial Literacy

Malta Stock Exchange Announces Six Measures to Boost Liquidity in Capital Market

Malta Stock Exchange Announces Six Measures to Boost Liquidity in Capital Market